1. Introduction

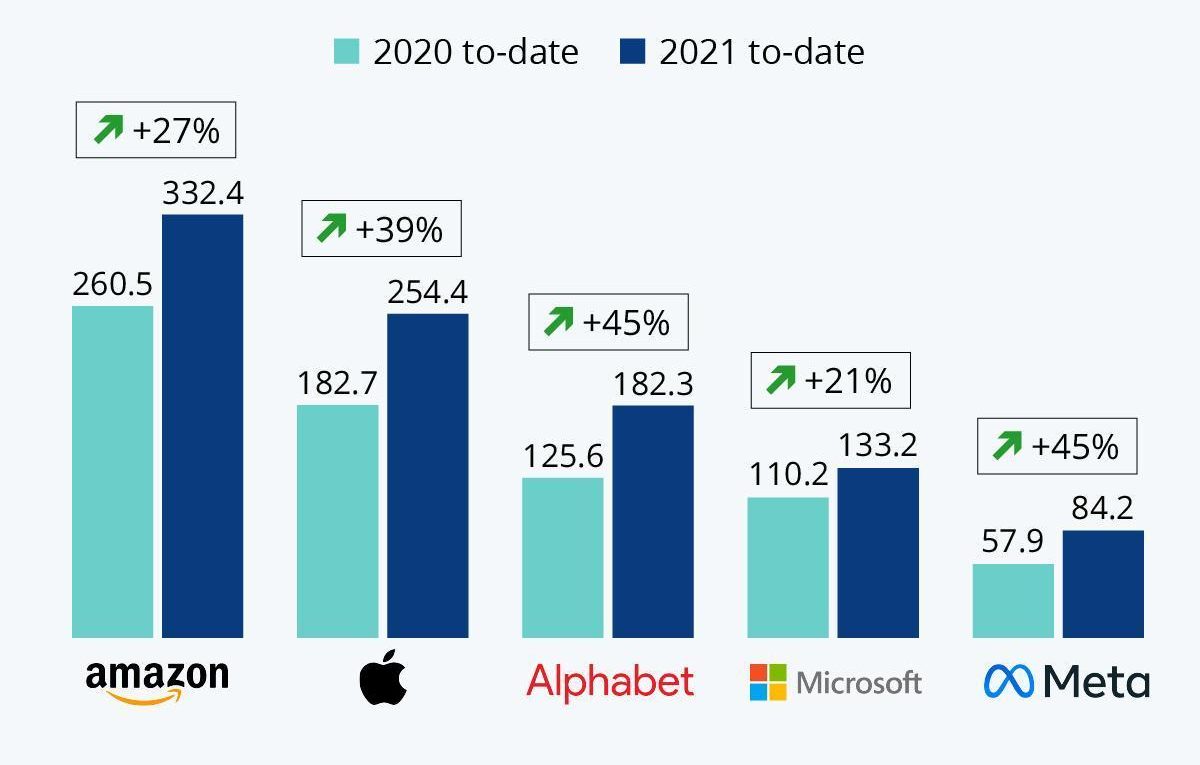

Even as the Covid-19 crisis wreaked havoc on the global economy, it gave rise to a small set of winners, namely Big Tech. This essay uses the term Big Tech to refer to the mega-corporations of the Global North, largely in the tech industry, such as the GAFAM collective (Google/Alphabet, Apple, Facebook/Meta, Amazon, and Microsoft). With the increasing prevalence of remote work and an acceleration of the digitalization of the economy, these companies saw an enormous rise in revenues during the pandemic (Figure 1).

Figure 1: GAFAM revenues during the pandemic (“To -date” refers to October 2021).

Source: https://www.statista.com/chart/21584/gafam-revenue-growth/.

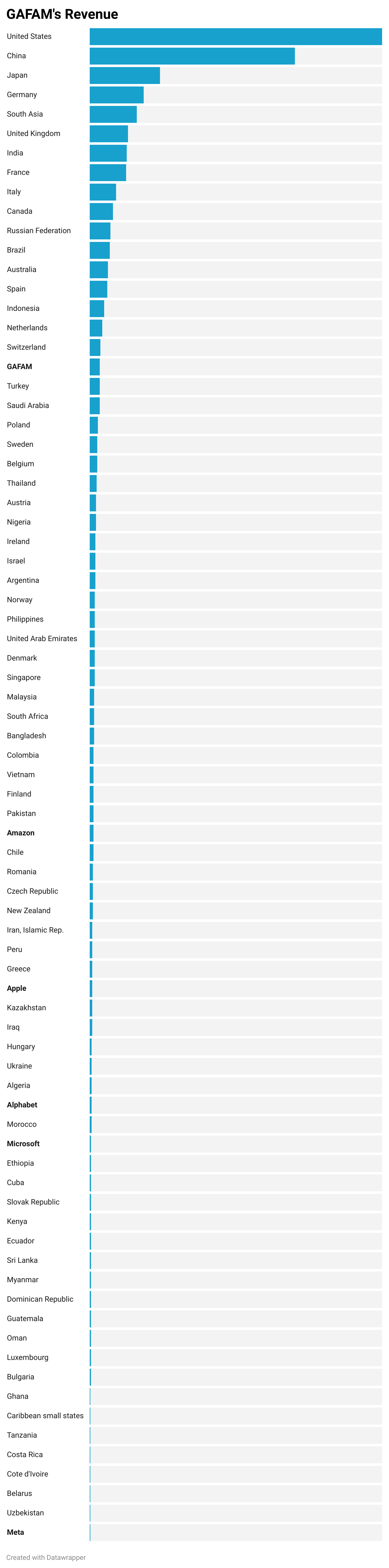

In some cases, their revenues dwarfed the gross domestic product (GDP) of several countries. For instance, Amazon’s USD 260-billion gross revenue in 2020, when compared to the nominal GDP of countries and sub-regions, and the revenues of other GAFAM companies, would make it the world’s 42nd largest economy. This statistic, alarming by itself, reaches ominous proportions when the combined revenue of GAFAM is taken into consideration.

Figure 2: If tech companies were countries

Source: Authors’ compilation, World Bank, Datawrapper

Figure 2 ranks countries by nominal GDP and compares them to the GAFAM collective, assuming it to be a country. The results are sobering. At USD 736.9 billion, GAFAM’s combined revenue in 2020 would make it the 18th largest economy in the world. It would be larger than 168 countries and jurisdictions, including major economies such as Poland, Sweden, Ireland, and Israel.

If we consider the companies that are part of the GAFAM collective as individual countries, Amazon, as mentioned, would be the 42nd largest economy, Apple the 51st, Alphabet the 57th, Microsoft the 59th, and Meta/Facebook the 79th. Each of these companies is now richer than dozens of countries combined.

The effective taxation of these staggering revenues and profits, which pose fundamental challenges to the existing system of international taxation, is something countries around the world have been struggling with. This essay examines this phenomenon and suggests alternative measures for taxation of the digitalized economy. Accordingly, Section 2 of this essay explores the rising untaxed profits of Big Tech in particular, and the digitalized economy in general, and explains why the existing rules are insufficient. Section 3 critically examines the solution that has been devised by the Organisation for Economic Co-operation and Development (OECD), an intergovernmental organization of developed countries. The final section outlines alternative options that are more suitable for developing countries. The focus is on developing countries as they are the ones struggling to tax Big Tech companies which are deriving profits from their jurisdictions without paying their fair share of taxes to them.

2. How Big Tech Consolidated Power During a Pandemic

2.1. An Entrenched Tech Oligopoly

Big Tech has turned into an entrenched tech oligopoly, aided by the Covid-19 pandemic. Their revenues enable the companies to keep prices artificially low, crushing the competition and acquiring those that survive. Amazon, in fact, had a “Gazelle” unit whose task was to hunt down and buy out competitors “the way a cheetah would pursue a sickly gazelle”.

The larger these companies get, the more unequal become their terms of engagement with dependents. For example, producers and sellers interacting on the Amazon platform have to pay the company a fee for the services provided. The more entrenched Amazon becomes, the more the number of producers and sellers who will be forced to use it. In this sense, it begins to earn a significant income through ‘rent’, based solely on its market dominance rather than innovation.

Tech giants can and do abuse such market power. In 2020, Google said apps on its Play Store platform would have to use the Google billing system, essentially forcing them to pay the company a ‘cut’ of in-app purchases. This began to be known as the “Google tax”. There are similar examples of an “Amazon tax” and a “Microsoft tax” with the same underlying rationale, i.e., forcing users to pay for the use of the underlying infrastructure.

The immense political implications of such power have been particularly well-documented in the case of social media platforms. Scams like Cambridge Analytica, in which Facebook abused user information for political purposes, have revealed the impact of such oligopolies on the political lives of countries.

As mentioned earlier, market dominance is often achieved and reinforced through predatory pricing as tech giants price below cost and plow back the resulting revenues into further expansion. This strategy has allowed Amazon to grow beyond being only a retailer to operating as “A marketing platform, a delivery and logistics network, a payment service, a credit lender, an auction house, a major book publisher, a producer of television and films, a fashion designer, a hardware manufacturer, and a leading host of cloud server space.”

This strategy also means that firms have meager profits, which are further diluted through generous tax provisions such as deductions for accelerated depreciation, net operating loss carryforward, and tax credits. The most controversial provision in this regard relates to stock-based compensation deductions. In practical terms, this benefits large shareholders, often the CEO and board members, who pay themselves enormous bonuses and increase their wealth while using this to lower the company’s tax liabilities.

2.2. Limits of Existing International Tax Rules

Arguably the biggest driver of tech giants’ ability to reduce taxes is the inadequacy of current international tax rules. Article 7 of the United Nations Model Tax Convention and the OECD Model Tax Convention both state that non-resident multinational enterprises (MNEs) are only required to pay taxes on their business profits to a country if they have a physical presence, such as a branch, factory, office, workshop, etc., in that jurisdiction, as defined under Article 5 of both conventions. This made sense in the traditional brick-and-mortar economy but is becoming increasingly outdated in the digitalized world.

The biggest driver of tech giants’ ability to reduce taxes is the inadequacy of current international tax rules. Global UN and OECD conventions both require corporations to pay taxes if they have a physical presence in a country. While this made sense in the traditional brick-and-mortar economy, it is becoming increasingly outdated in the digitalized world.

The second limitation of the existing rules relates to the valuation of intangibles. Big Tech is heavily reliant on intellectual property (IP), such as software and algorithms, to create value. The common strategy is to locate the IP in a tax haven — Ireland is a big favorite — and then have the subsidiaries pay the parent company royalties for the ‘right to use’. These royalties are often highly inflated, enabling the subsidiary to declare low-to-zero profits in the jurisdiction where it operates, thereby escaping taxation. Given the complex transactions and business models, tax administrations are hard pressed to determine whether the royalty payment is indeed priced at the market rate. The revenues which are shifted to the tax haven in the process, enjoy a low or no tax rate, and thus enable Big Tech MNEs to expand their overall war chest.

2.3. Big Tech, Small Tax

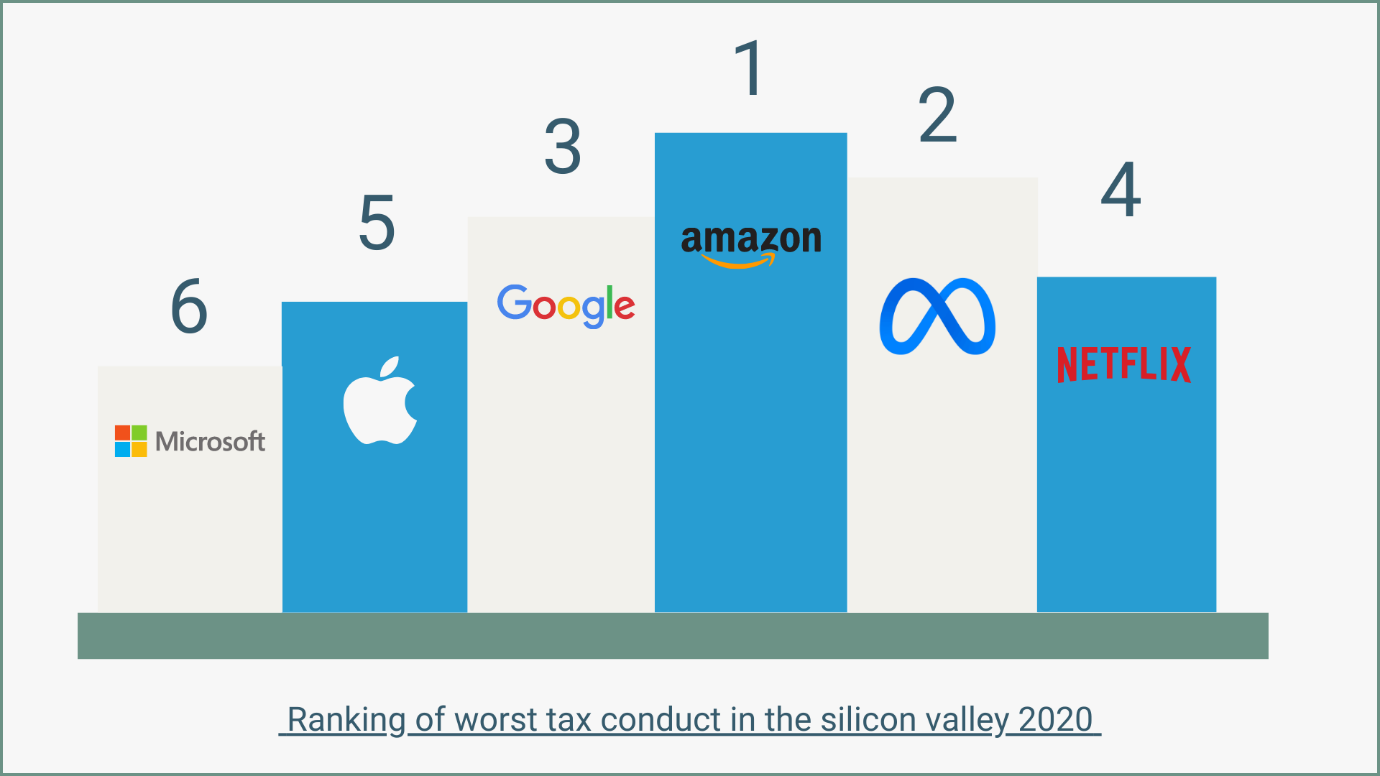

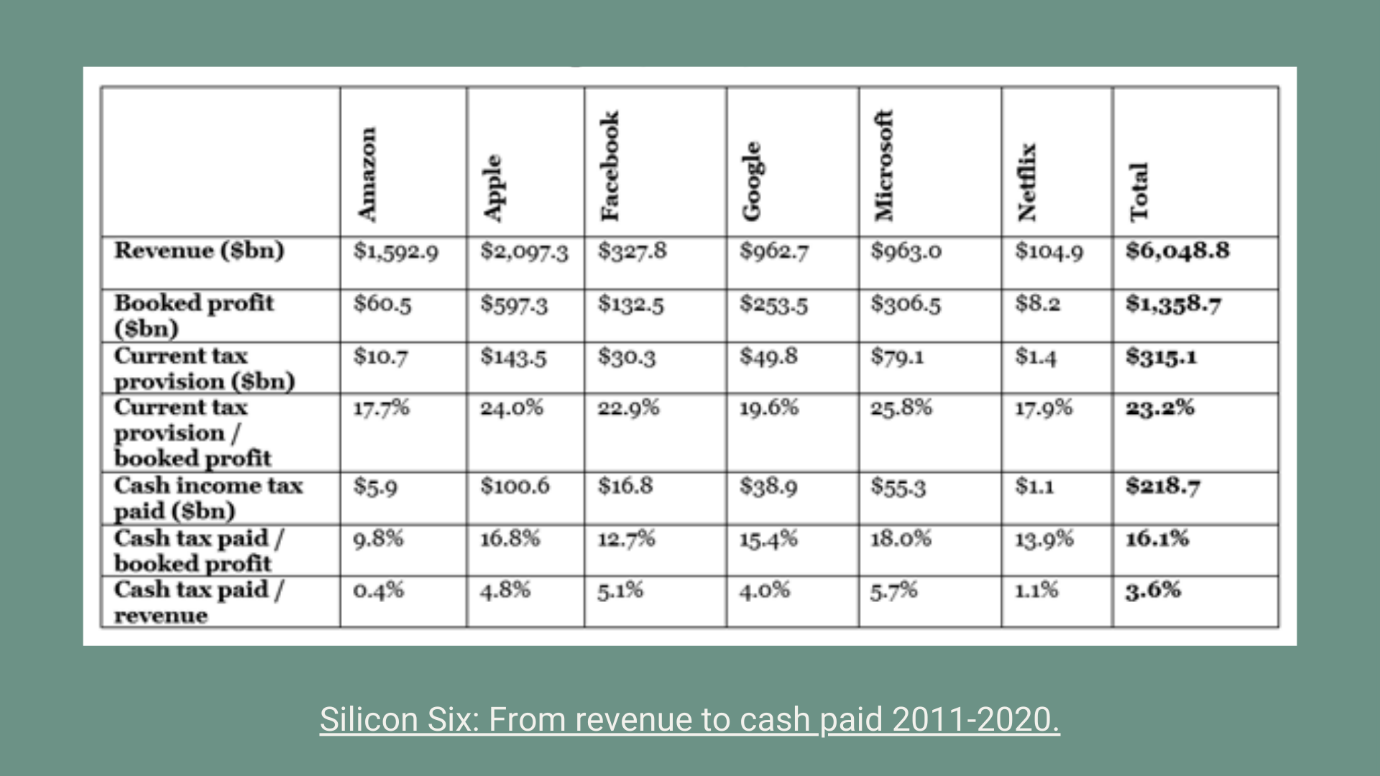

The cumulative effect of the above-mentioned factors is that the taxes paid by Big Tech are shockingly low, with some companies, such as Amazon, paying zero tax in their parent jurisdiction, the United States. An analysis of the ‘Silicon Six’, which includes FAANG (Facebook/Meta, Amazon, Apple, Netflix, and Google/Alphabet) and Microsoft, pegged their ‘tax gap’ – the difference between what they should have paid and what they actually paid in taxes — at a staggering USD 100 billion (approximately) for the period 2011-2020. More specifically, as the Fair Tax Foundation states, “the gap between the expected headline rates of tax and the cash taxes actually paid by the Silicon Six was USD 149.4 billion”. Furthermore, the Foundation reports that, “the gap between the current tax provisions and the cash taxes actually paid by the Silicon Six was USD 96.3 billion”.

Figure 3: Hall of Shame

Source: Fair Tax Mark (see here: https://fairtaxmark.net/silicon-six-end-the-decade-with-100-billion-tax-shortfall/)

As Figure 3 shows, Amazon is the worst offender among the Silicon Six while Microsoft is at the bottom of the list (for details of their tax payments, see Table 1). Their cumulative USD 100-billion tax gap equals the amount of climate finance that should be given by the developed countries to the developing countries, annually, under the Paris Agreement and is almost half of Africa’s annual USD 200-billion SDG finance gap.

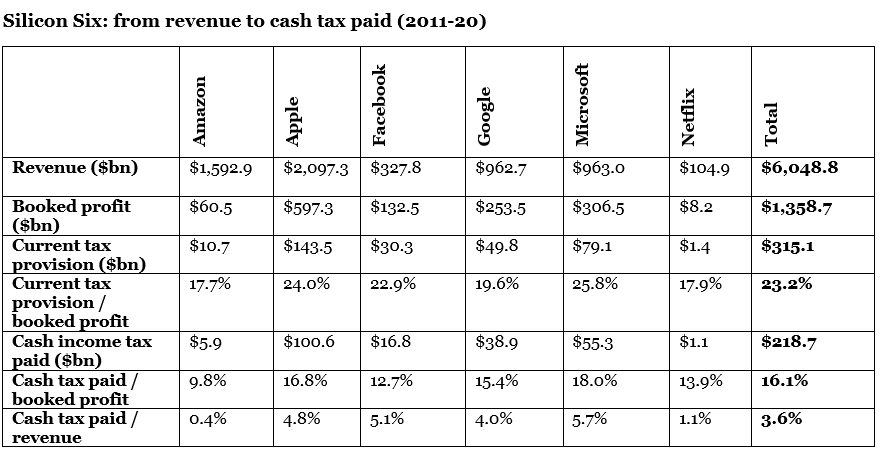

Table 1: Silicon Six: From Revenue to Cash Tax Paid (2011-20)

Note: The row on “cash income tax paid” is the actual taxes paid.

Source: Fair Tax Mark (see here: https://fairtaxmark.net/silicon-six-end-the-decade-with-100-billion-tax-shortfall/)

Against this backdrop, the next section explores developments at the multilateral level aimed at providing a solution. It focuses on the key organization — the OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS) — and its “Two-Pillar Solution”.

3. The Two-Pillar Solution: A Deal of the Rich

3.1. A Brief History of the BEPS

The Two-Pillar Solution is an output of the OECD Inclusive Framework on BEPS, a project the OECD initiated at the behest of the G20 during the 2008 Great Recession. In dire need of funds to stimulate their economies out of the recession, the G20 and the OECD countries turned to taxes as one of the sources of funds. Accordingly, they mandated the OECD to update the rules of international taxation to end tax avoidance and evasion. In July 2013, the OECD unveiled its “15 Actions” which addressed various aspects of international taxation such as interest deductibility, artificial avoidance of permanent establishment, exchange of information, etc.

Of the 15 Actions, all save one were finalized by 2015. The Inclusive Framework, the Forum where the BEPS project was developed, could not come to a consensus on Action 1 that sought to address the issue of how to tax the digital economy. The work was kept pending till 2020 when a final solution was expected. Both developed and developing countries grew dissatisfied with the lack of a solution, especially as Big Tech continued to get bigger, and resorted to unilateral measures. These took various forms, but the most common were digital service taxes, which are taxes collected on gross revenues from services provided online such as advertisements or over-the-top (OTT) subscriptions.

In turn, these measures incurred the wrath of the U.S., the home of Big Tech, which threatened some of these countries with trade sanctions through its infamous Special 301 mechanism. Under this unilateral coercive measure, the U.S. can determine that the economic policy of another country is not to its liking, and thus deserves to be punished. The determination is made after an investigation by the U.S. Trade Representative, which typically acts upon complaints by U.S. business lobbies. To date, the mechanism has been invoked against a handful of mostly developed countries, such as France and Austria, but also a few developing countries such as India and Indonesia make the list.

The threat was, however, put ‘on hold’ till the finalization of the Two-Pillar Solution. The not-too-subtle message was that if countries refused to accept the OECD’s solution and resorted to unilateral measures, the threat would be reactivated.

The possibility of trade sanctions on major economies would have been damaging for the global economy already affected by the ongoing U.S.-China trade war. Accordingly, the OECD began to greatly accelerate the pace of negotiations on Action 1 of the BEPS Project. Eventually, three competing proposals reached a deadlock: (i) “marketing intangibles” by the U.S., (ii) “user participation” by the United Kingdom, and (iii) significant economic presence by the G24 group of developing countries.

The deadlock was broken by the OECD Secretariat which prepared a ‘Unified Approach’ that sought to “integrate” common elements of the three proposals. This was fairly unusual in the history of international organizations as secretariats are supposed to remain politically neutral and not intervene in negotiations. It also showed just how powerful the OECD Secretariat was as a political actor in the entire process. The fact that it was solely accountable to the OECD member states — the richest in the world — was another deeply problematic aspect of the negotiations.

The Unified Approach received the approval of the Inclusive Framework’s members and became the basis for future negotiations. From then on, it was known as Pillar One. A global minimum corporate tax was then instituted to cover any remaining BEPS issues. This tax was known as Pillar Two. Together, they formed the Two-Pillar Solution to address the tax challenges arising from the digitalization of the economy that received final approval on 8 October 2021. In reality, only Pillar One focused on the taxation of the digitalized economy.

3.2. Pillar One: A Solution that Minimizes Tax Liabilities for Big Tech

Pillar One is largely based on the original American proposal of ‘marketing intangibles’ and has been clearly designed to protect American Big Tech firms from taxation. It has a high taxation threshold set at a global turnover of EUR 20 billion and a profitability of over 10%. Its scope, is therefore, limited to about a hundred MNEs. The second filter which determines if a country can tax an MNE is the requirement that at least EUR 1 million of its revenues must be derived from that jurisdiction. This again is a high threshold, as was pointed out by Zainab Ahmed, the Finance Minister of Nigeria at the First African Fiscal Policy Forum.

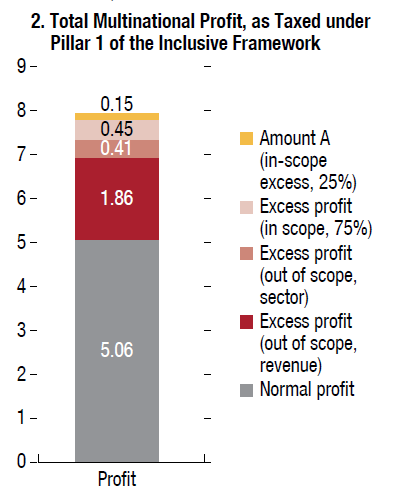

These stringent scope rules reduce the number of taxpayers. The second aspect relates to the quantum of taxes that must be paid. Under Pillar One’s highly complex rules, developing countries are unlikely to receive much profit allocation, which is the share of the MNE’s profit that will be allocated to an individual country to be taxed at its domestic rate. This is mainly because profit allocation is limited to a tiny proportion of the total MNE profit, namely, 25% of the so-called non-routine or residual profits defined as profits in excess of 10% of revenue. This 25% of residual profits, called “Amount A”, is what will finally be redistributed to market jurisdictions. Figure 4, which reproduces an illustration by the International Monetary Fund (IMF), demonstrates how Amount A forms a minuscule portion of total MNE profits.

Figure 4: Total MNE profit as taxed under Pillar One

Source: IMF Fiscal Monitor, April 2022

Both the high thresholds for taxation and the fact that only 25% of the residual profit is to be allocated to market jurisdictions, fail to fulfill the demands of developing countries. Market jurisdiction, for the purpose of Pillar One, is defined as countries that were unable to impose taxes in the digitalized economy under existing international tax rules and would receive the “new taxing right” under Pillar One. The G24 had strongly demanded that at least 30% of the residual profit should be redistributed to market jurisdictions. But this, along with many other proposals and demands made by developing country organizations, such as the G24 and the African Tax Administration Forum (ATAF), were ignored. In some instances, only minor aspects of their demands were incorporated.

The Financial Accountability Transparency and Integrity (FACTI) Panel, the Independent Commission for the Reform of the International Corporate Taxation (ICRICT), and civil society organizations, such as the Global Alliance for Tax Justice and Tax Justice Network, had called for greater fairness and ambition in the international tax reform processes, but these voices too were largely ignored.

This has resulted in a weak and watered-down proposal, which barely taxes Big Tech and does not promote fairness in the international tax system, especially in a context where governments are grappling with an extreme resource crunch and the challenge of economic recovery from the Covid-19 pandemic. In the words of Shaukat Tareen, the former finance minister of Pakistan, Pillar One “has nothing for developing countries”.

3.3. Pillar Two: A Solution to Further Enrich Developed Countries

Pillar Two, which is the global minimum corporate tax, is evidently designed to drain resources from developing into developed countries. It functions through four interlocking rules. If a taxpayer has an effective tax rate, meaning taxes actually go into the government’s bank account, of less than 15%, then three rules are triggered that have to be applied sequentially. These are:

- Qualified Domestic Minimum Top-Up Tax (QDMTT): The source country can apply the QDMTT to a modified tax base to bring the ETR up to 15%.

- Income Inclusion Rule (IIR): If the source country chooses to do nothing, the difference between the ETR and 15% is collected by the country where the MNE is headquartered, known as the Ultimate Parent Entity (UPE) jurisdiction. For example, if Microsoft has an ETR of 2% in Zimbabwe, and Zimbabwe refuses to take measures to bring it up to 15%, then the remaining 13% will be collected by the U.S.

- Undertaxed Payments Rule (UTPR): If the UPE and intermediate parent jurisdictions (in the case of Facebook, for instance, these would be the U.S. and Ireland, respectively) refuse to collect the tax, then finally the source country can deny deductions until the ETR of 15% is reached.

The aforementioned three rules are called the ‘GloBE’ rules and are triggered if the ETR is below 15%.

Another aspect of Pillar 2 is the Subject to Tax Rule (STTR). This is different from the GloBE rules in that, instead of net income calculated annually, it applies as a withholding tax on each individual payment where the nominal rate is below 9% for a defined set of categories that are still under negotiation, but would, at a minimum, include interest and royalties. Its application can be demonstrated through the following example. Assume a mining company which is a taxpayer in a developing country and pays its MNE affiliate in a tax haven an amount for interest payments on a loan taken from that affiliate, and

2a. the nominal tax rate on that payment in the tax haven is below 9% (say 3%),

2b. there is a tax treaty between the two,

2c. the existing withholding tax rate on interest payments is below 9% in the treaty (say 4%).

In this case, the tax rate on the interest payment is 3% + 4% = 7%, which is below the STTR rate of 9%. Accordingly, the developing country can request the treaty partner to include the STTR into the treaty. Once done, the STTR will be activated and a top-up tax will be applied, which will add an additional 2% withholding to bring up the rate on each interest payment to 9%. Since the STTR applies on each payment, it technically comes first in the rule order, and is used to determine the annual ETR of the taxpayer.

Under the rule order of Pillar Two, if the source country chooses not to apply the QDMTT, the priority for collecting the minimum tax of 15% is given to the jurisdiction where the UPE of the MNE is based, which are usually developed countries. Major tech giants, such as Facebook, Google, Apple, etc., all have their UPE in the U.S. If this jurisdiction refuses to exercise its right to tax undertaxed profits, the rule order gives the second ‘chance’ to the intermediate parent jurisdiction of MNEs. Only if both jurisdictions refuse to collect this amount does the source jurisdiction where the income arose gets its turn. This makes unlikely the possibility for source countries, which are mostly developing countries, to benefit from the minimum tax.

The STTR was introduced into Pillar Two because of efforts of the developing countries, led by India. They wanted to balance its blatantly one-sided design, which initially consisted only of the IIR and the UTPR, and would have allocated all undertaxed profits to the developed countries by giving the IIR, rather than the UTPR, priority in the rule order.

However, the STTR’s design too has been severely restricted in the negotiations. It will apply only to developing countries which have tax treaties, and as a rule, their tax treaty network is limited. The STTR rate of 9% is also unhelpful as, for most developing countries, withholding tax rates on interest and royalties are higher than 9% . The rate was capped at 9% because the overall minimum tax rate itself was too low at 15%. As a transaction-based rule, the STTR would directly contribute to the ETR computation, and thus had to be kept a few percentage points lower than the overall rate. In other words, had the overall rate been higher, the STTR rate too could have been higher. Lastly, developing countries demanded that the STTR cover capital gains and service fees, two major sources of tax avoidance. This is presently under negotiation. The G24, ATAF, and the South Centre have outlined various critiques of Pillar Two highlighting these deficiencies.

The U.S. wanted a higher minimum corporate tax rate of 21%, but a lower rate of 15% was settled upon, likely to appease European tax havens such as Ireland, which has a comparable rate of 12.5%. This ignored the demands of developing countries such as Argentina, which demanded a 25% tax rate, and organizations such as the ATAF and the South Centre which called for at least a 20% rate. The average corporate tax rate for developing countries is 25%, and so, the 15% rate for Pillar Two has been called “detached from developing country realities”.

It must be mentioned that the U.S. demand for a 21% rate was not out of concern for developing countries, but rather to punish U.S. corporations looking to offshore jobs. The U.S. sought to level the global tax playing field so that U.S. companies would have no tax-related incentives to offshore jobs. In this regard, the Joe Biden administration has retained the same goals as the previous administration led by Donald Trump but used different methods and a more progressive sounding narrative. Indeed, the bulk of both Pillar One and Pillar Two reflect American proposals and domestic laws. The South Centre, in a statement, outlined some of these key deficiencies of both Pillars of the Two-Pillar Solution.

4. Alternative Options for Developing Countries

Developing countries, including India, Nigeria, and Kenya, have already started generating revenues through unilateral measures like the equalization levy, which is a tax withheld on an online advertising service provided by a non-resident to a resident at the time of payment. If they decide to proceed with Pillar One, however, developing countries will have to accede to a Multilateral Convention (MLC) which, among other conditions, stipulates the removal of all unilateral measures that are currently a proven source of revenue. Besides, as per the 8 October 2021 Agreement in the OECD Inclusive Framework, the removal of unilateral measures will apply to all companies, not just those that come under its scope.

As an urgent policy decision, developing countries need to consider alternative ways to tax the revenues that Big Tech companies generate in their jurisdictions and not rely on the Two-Pillar Solution. Such a response may even act as leverage for an early and comprehensive review of the Solution to make it more conducive for developing countries.

This section explores three main alternatives, besides the ongoing unilateral measures already implemented by countries such as the above-mentioned equalization levy applied by India, significant economic presence by Nigeria, and digital service taxes by Kenya.

4.1. Article 12B of the UN Model Tax Convention

At its 22nd session in April 2021, the UN Tax Committee approved a revision of the UN Model Convention to include Article 12B on income from automated digital services (ADS). ADS, defined as activities that require “minimal human intervention and are administered through electronic network and internet”, includes online advertising services, supply of user data, online search engines, online intermediation platform services, social media platforms, digital content services, online gaming, cloud computing services, and standardized online teaching services. Article 12B can be inserted into any bilateral tax treaty between countries that seek to tax incomes from ADS coming from a foreign country. For instance, if country X wishes to tax Google Ireland’s income from ADS, it would need to include Article 12B in its bilateral tax treaty with Ireland.

Article 12B does not require any threshold and is considered a simpler solution for developing countries. It will allow them to gain a share of the entire profit deriving from the jurisdiction instead of a small share of the non-routine profit as in Pillar One. Both businesses and tax administrations will likely find it easy to comply with.

Income from ADS may be taxed in a jurisdiction if this income is paid by a resident of that jurisdiction or a non-resident with a permanent establishment in that state, considering that the payment is borne by the permanent establishment or fixed base.

Under this method, two approaches may be carried out. Income from ADS may be taxed through a gross withholding tax or through a net profit basis tax. In the withholding tax approach, the taxation rate is bilaterally negotiated between the contracting countries and the tax revenue is collected in the payer jurisdiction on each transaction, on the gross payment made to the receiver (or the beneficial owner, in case it is made indirectly) of the income. Thus, if a consumer in Country X pays Google for an online advertisement, Country X would retain a portion of the payment as a withholding tax. In case there is no tax treaty between the countries, Country X can consider introducing a domestic law modeled on Article 12B.

In the net profit basis approach, taxation in the source jurisdiction will be made on the “qualified profits” of the MNEs, which is 30% of the “gross profit” (the amount resulting from applying the profitability ratio of the ADS business segment or the overall profitability ratio to the gross annual revenue from ADS derived from the jurisdiction where such income arises). The profitability ratio is in general assumed to be (gross profit/net sales)*100, where the gross profit is the net sales minus the cost of goods and services. This ratio may vary depending on the business segment since MNEs may use the ratio that best fits their business.

Practically, developing countries should, as a first step, identify all individuals and MNEs providing ADS in their countries for which payments are made according to the definition of such services. Secondly, they should choose whether the gross basis solution or the net basis solution is suitable for easier revenue mobilization, knowing that the net basis solution will require more data from the MNE.

4.2. Excess Profit Taxation

Covid-19 has destabilized the market equilibrium and created an imperfect market where a few companies, especially Big Tech, have obtained a monopolistic position, allowing them to earn excess profit. These are referred to as ‘excess’ profits as they have nothing to do with the performance of the company or its investment in research and development. The lockdown increased demand for their goods and services, and in some cases, also led to the closure of some businesses, especially small businesses, paving the way for Big Tech companies to make these ‘excess’ profits.

Especially during the pandemic, companies such as Amazon used their dominant market position to entrench and expand market share by picking up the demand for small businesses that were forced to close. This income is akin to rent, that too a monopolistic rent, which can be taxed highly, as a matter of fairness, to generate funds for pandemic recovery in the U.S. and around the world.

A July 2020 study by Oxfam America has shown that 17 of the top 25 most profitable U.S. companies (including Big Tech ones such as Microsoft and Facebook) were expected to make almost USD 85 billion more in 2020 as super-profits compared to the previous year. Taxing this excess profit could raise almost USD 80 billion annually. without hampering the productivity of MNEs since these excess profits are not influenced by companies’ internal factors.

The pandemic also paves the way for a rethinking of this strategy that was used during the World Wars. Two methods may be used for taxing excess profits. The first is the average earning method and the second is the invested capital method. The former is based on excess profits above the average earnings for a specified number of years, for instance, the past three or five years. Profits above this average amount may be considered as excess profits and taxed at a higher rate.

The latter method is based on excess profits above a given standard rate of return on investment. Profits above this set rate of return on investment may be taxed at a higher rate. There are instances of excess profits being taxed up to 95%. Developing countries may decide on the tax rate based on additional employment created during that period, for example. However, taxing excess profit requires availability of and access to the MNE group’s financial documents.

4.3. Unitary Taxation with Fractional Apportionment

Formulary apportionment is another method that has been used in countries such as the U.S. and Canada to levy taxes on MNEs, and takes into account the global income, assets, and payroll of the corporate group. The G24 has recommended a variation of this method for taxing the digital economy, and especially tech companies. In this variation, known as fractional apportionment, the profit to be taxed in a jurisdiction will be a function of the proportion of the group’s sales derived in that jurisdiction and the proportion of the group’s property or assets and labor located in it. For activities conducted via remote presence, countries may refer to sales and users as factors, instead of payroll and assets, given that the corporate group may not have assets in the jurisdiction.

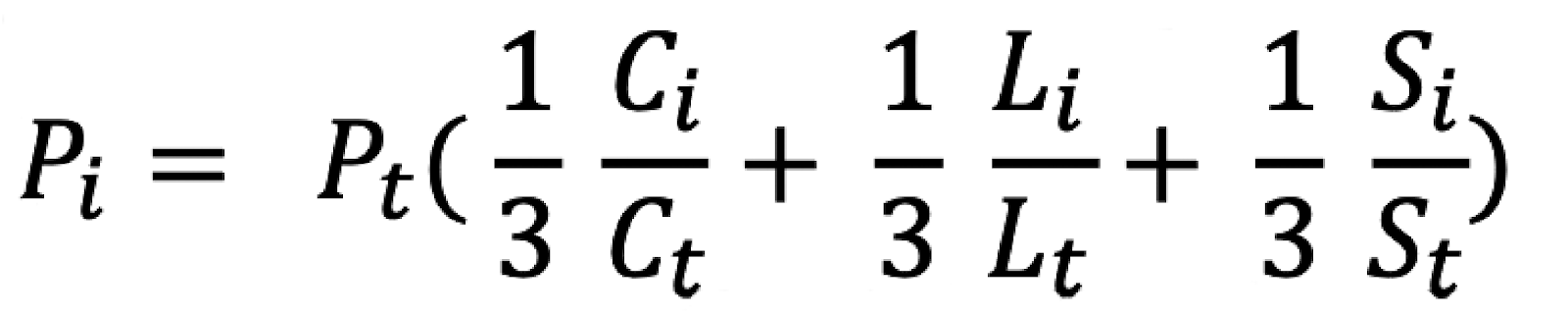

The formulary method may be described mathematically as follows:

where Pi represents profits allocated to the jurisdiction i, Pt profits of the MNE group, Ci represents the group’s property or assets in jurisdiction i, Ct the group’s all properties or assets, Li represents labor of the group in jurisdiction i, Lt labor for the whole group, Si sales of the group in the jurisdiction i, and St represents the global sales of the group.

This may allow developing countries to avoid the OECD’s formulaic apportionment method for a simpler version. To do so, the G24 has proposed, as a first step, the determination of the “allocated profit” by multiplying the group revenue by an indicator for the operating profit. The second step will be to allocate a part of the profit to the market jurisdictions based on a formula which will consider participation in global sales and users.

5. Conclusion

Developing countries have a plethora of options for taxing Big Tech, Pillar One of the OECD being only one of them. The option they choose must be based on a careful cost-benefit analysis of the revenues that accrue from the various alternatives. This data must also be publicly disclosed so that an informed debate can take place in legislatures and the public sphere.

Developing countries have a plethora of options for taxing Big Tech, alongside the OECD model. The option they choose must be based on a careful cost-benefit analysis of the revenues that accrue from the various alternatives.

A developing country contemplating proceeding with Pillar One should first ‘wait and watch’ to see whether the developed countries ratify it. Since Pillar One involves the surrender of profit from developed to developing countries, if major economies like the U.S. and EU do not accede to it, there is no point in developing countries doing so as they will have nothing to gain from it. One study estimated that 64% of the profit to be redistributed under Pillar One would come from U.S. companies, making U.S. ratification of Pillar One critical.

Moreover, unless developing countries have overwhelming evidence that Pillar One is in their favor, they should proceed with alternative policy options. This will force the OECD countries to come back to the negotiating table and revisit some of its most egregious aspects.

Lastly, developing countries must also demand that the Multilateral Convention (MLC) contain a provision that allows any aspect of Pillar One to be modified. At present, the only aspect that can be changed is the EUR 20-billion threshold. It is unheard of for an international treaty to be structured such that only a single component can be reviewed. This reform too must be a key demand of developing countries. It will allow for a more sustainable multilateral solution for taxation of the digitalized economy.

Already, developing countries have started organizing a response to the Two-Pillar Solution, supported by Global South international organizations such as the African Tax Administration Forum, West African Tax Administration Forum, Coalition for Dialogue on Africa, G24, and the South Centre. These organizations are advocating against coercive measures being directed at countries that reject the OECD deal, and supporting countries in making an informed decision on whether or not to accede and pursue alternative measures, if necessary, for the taxation of the digitalized economy.